How Can We Help?

We help you uncover the ideal financial protections tailored to your needs.

Let's Talkcontact info

Phone

P: 905-792-8112

M: 647-226-8921

F: 905-793-8599

frank@csrwealth.ca

Location

17 Jerome Crescent, Brampton, ON L6S 2G9

Financial Planning

A financial plan provides clients with a clear picture of where they stand financially and where they need to get to in order to achieve their financial goals. It provides answers to common questions like, “When can I retire?” or “How much do I need to save for retirement?”.

A financial plan allows clients to stop making assumptions about their finances and instead, to uncover the real facts so that ultimately, they can enjoy peace of mind.

Questions that a financial plan can answer include:

- Am I saving enough?

- Am I on track to retire when I want to?

- Do I have things in place to minimize taxes in retirement?

- Are my accounts invested appropriately based on my risk tolerance and time lines?

- If I die, will my family be okay financially?

- Do I need a TFSA or RRSP?

- How much do I need to save for my child’s education and how does the RESP work?

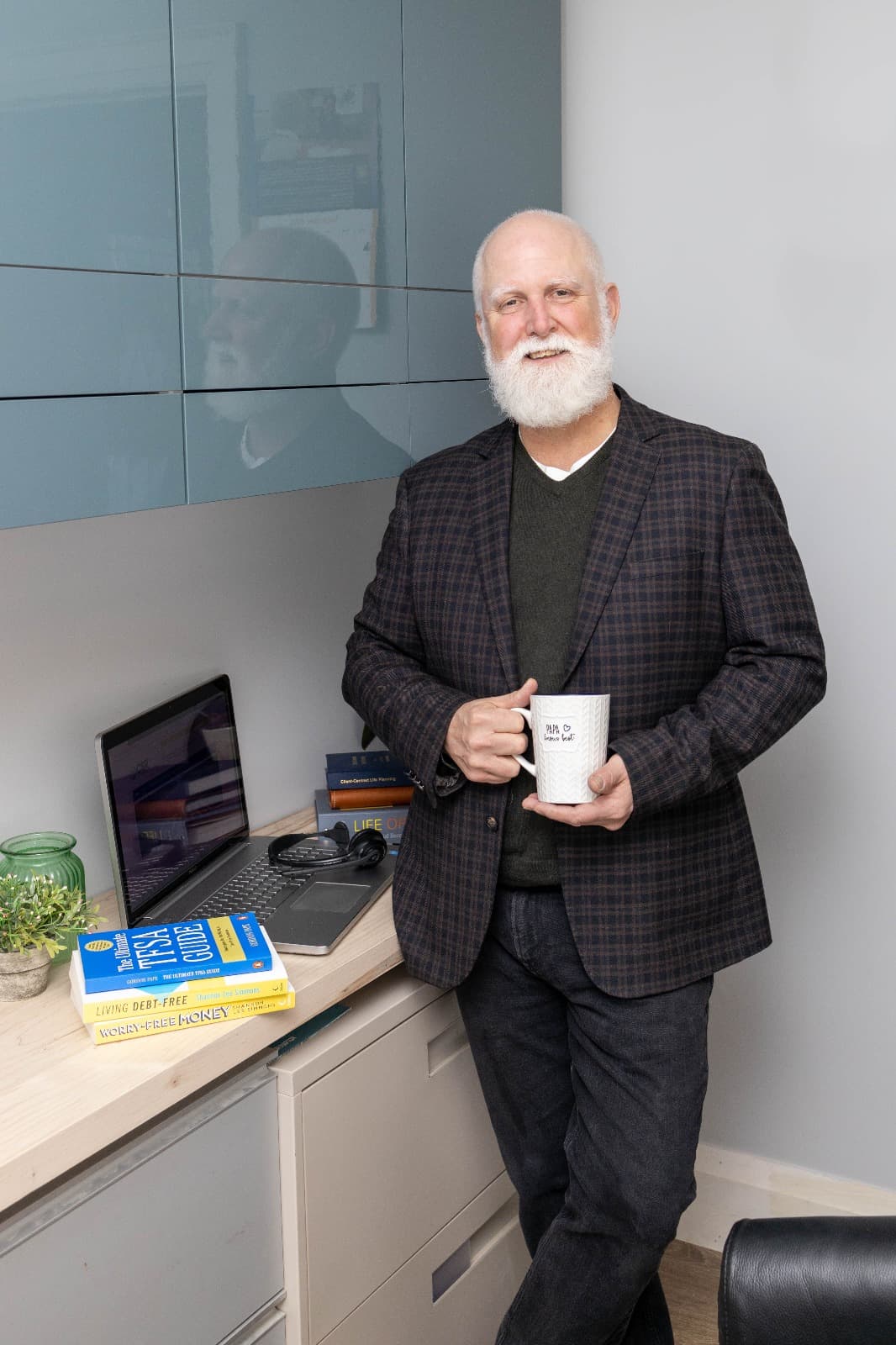

Book a no obligation meeting with Frank

At CSR Wealth, your financial planning process will include: